Investing in stocks always carries an element of risk, but for those willing to delve into the less-traveled paths, there might be hidden opportunities waiting to be uncovered. This article explores some of the underestimated stocks around the world, shedding light on potential opportunities that may not have garnered the attention they deserve. It’s important to note that this discussion is not financial advice but rather an exploration of potential investment opportunities based on research.

-

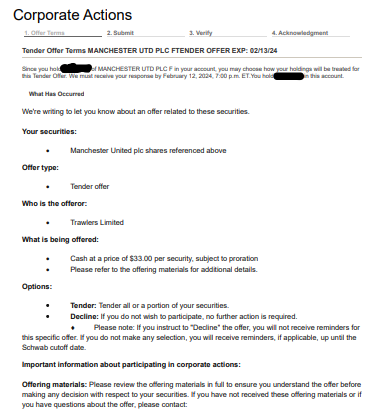

- Manchester United (NYSE: MANU):

One stock that often finds itself overlooked in the investment landscape is Manchester United, the renowned English football club. Despite its global fan base and iconic status in the sports world, the stock is sometimes underestimated in the financial markets.

Recently, there has been an interesting development with British billionaire Jim Ratcliffe expressing interest in acquiring the club at $33.00 per share. Ratcliffe, known for his successful ventures in the petrochemical industry, sees potential in the club’s brand and its ability to generate revenue through various channels, including broadcasting rights, merchandise, and sponsorship deals.

In a recent feature on ‘British Brilliance Unveiled: Wyoming Investors 2024 Pursuit of the Best UK Stocks,’ Wyoming Investor highlighted Manchester United as a global brand with immense potential. However, it’s intriguing to note that despite its iconic status, certain voices from the financial world have been casting shadows on the stock. Surprisingly, no prominent firm has recognized Manchester United as a top stock, and only one Wall Street analyst has said the stock is a ‘moderate buy’ and that’s considering even as British billionaire Jim Ratcliffe has made a notable offer of $33 per share. What’s even more perplexing is the stark increase in stock value from $11.51 on August 5th when first mentioned to $19.50 in the latest discussion—an impressive 69.23% surge.

This stark contrast between the stock’s performance and its perceived undervaluation by some pundits underscores the importance of seeking Business Consultants that specialize in market research. Here at Wyoming Investor we can conduct comprehensive analyses of the new market, providing insights into consumer behavior, competitor landscapes, and regulatory environments. This information is critical for making informed market entry decisions. You might be interested to learn more about our small business consulting services.

Underrated Stocks: Opinion of Wyoming Investor

Coca-Cola Femsa S.A.B. de C.V. (KOF): Mexico

Coca-Cola Femsa, the largest franchise bottler of Coca-Cola products in the world, might be an underrated stock despite its global brand association. With a significant presence in Mexico and Latin America, the company has been steadily expanding its footprint. As the beverage industry evolves and consumer preferences change, Coca-Cola Femsa’s stock could offer untapped potential for investors looking to diversify within the Mexican market.

Japan Tobacco Inc. (2914.T): Japan

Japan Tobacco, often overshadowed by other industries in Japan, stands out as a potentially underrated stock, especially considering its dividend history. The company has a strong market share in the tobacco industry, and its consistent dividend payments could make it attractive to income-focused investors. With a global presence, Japan Tobacco’s stock may offer stability and income generation that is sometimes overlooked.

Microsoft Corporation (MSFT): United States

Microsoft, a tech giant, is often associated with its software and hardware products, but its investments in artificial intelligence (AI) are sometimes undervalued. With initiatives like Azure AI and significant acquisitions in the AI space, Microsoft is positioning itself as a leader in the future of technology. The stock’s potential for growth in the AI sector might be underappreciated compared to its more traditional offerings.

It’s crucial for investors to conduct thorough research, consider their risk tolerance, and stay informed about global market trends before making any investment decisions. Additionally, seeking advice from financial professionals can provide valuable insights tailored to individual investment goals and strategies.

Conclusion:

Investors are often drawn to well-established stocks, but there can be hidden opportunities in lesser-known entities. Manchester United’s potential acquisition by Jim Ratcliffe, Japan Tobacco Inc’s position in the Japanese market, and Microsoft’s diverse business model are just a few examples of stocks that might be underestimated in the broader market.

As a business owner, recognizing the importance of the stock market goes beyond its role as a platform for investments. It serves as a dynamic indicator, reflecting the pulse of the global economy and influencing business decisions. The hidden gems within the stock market offer opportunities for diversification and wealth accumulation, serving as a supplementary avenue for capital growth.

While identifying undervalued stocks presents a potential for increased returns, it is crucial for business owners to approach this realm with diligence. Seeking advice from a qualified financial representative becomes pivotal, ensuring that investment decisions align with business objectives, risk tolerance, and long-term goals.

Moreover, the stock market’s significance extends to strategic business planning. Understanding market trends and investor sentiments provides valuable insights that can shape business strategies, product offerings, and expansion plans. Navigating this intricate landscape necessitates a nuanced approach, and a financial representative can serve as a valuable partner in this journey.

In parallel, just as in the stock market, business success often hinges on finding a niche. Engaging a skilled business consultant can help business owners identify unexplored opportunities, refine strategies, and carve out unique spaces within competitive markets. The stock market and entrepreneurial endeavors share the common thread of requiring expertise to uncover hidden potentials.

Ultimately, for business owners, the stock market is not merely a realm for financial investments but a dynamic force that can inform and enrich strategic decision-making. By embracing its nuances and seeking professional guidance, business owners can leverage the opportunities it presents, fostering growth, resilience, and long-term success.

Disclaimer: The information provided in this response is for informational purposes only and should not be construed as financial or investment advice. The content is based on publicly available information and general observations, and it does not take into account your specific financial situation, investment objectives, risk tolerance, or any individual circumstances. Investing in stocks involves inherent risks, and decisions should be made after careful consideration of your unique financial position and consultation with a qualified financial advisor. The views expressed in this response are opinions and should not be considered as recommendations for buying, selling, or holding any particular stock or investment. Always conduct your own research and seek professional advice before making any investment decisions.