Debt is a double-edged sword for businesses. On the one hand, it can provide the capital needed to invest in growth opportunities and expand operations. On the other hand, excessive debt can become a burden that hinders a business’s ability to operate and grow. In this article, we’ll explore why debt is not always a good thing for businesses.

First and foremost, debt can be a significant drain on a company’s finances. For instance in 2021, AT&T announced plans to spin off its WarnerMedia division and merge it with Discovery Inc. to help pay down its massive debt load. The company had accumulated a debt load of over $180 billion due to its acquisition of Time Warner and investments in 5G technology.

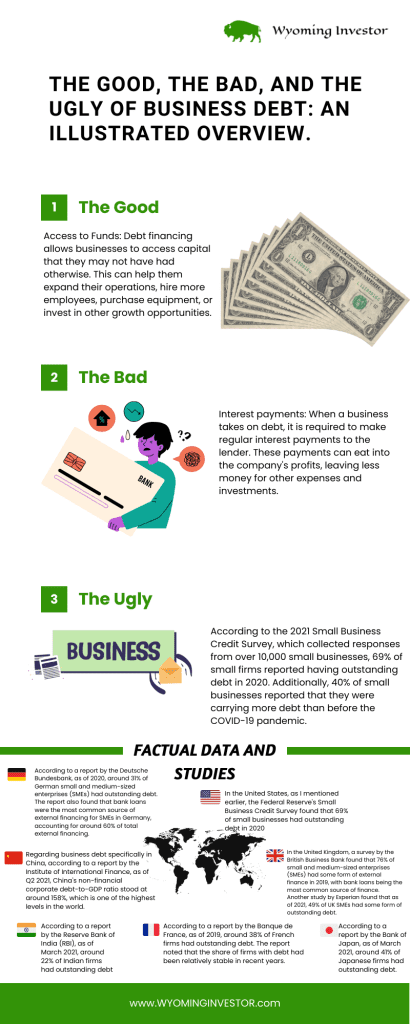

When a business takes on debt, as with AT&T it has to make regular payments to service that debt, usually in the form of interest payments. When a company has a debt, it must make regular interest payments to its lenders. These interest payments can be a significant drain on a company’s cash flow, reducing its ability to invest in growth opportunities or pay dividends to shareholders. For AT&T, its interest payments were expected to be over $15 billion in 2021 alone, which is a substantial amount of money for any company. These payments can add up quickly and eat into a business’s profits. The more debt a business has, the more interest it will have to pay, and the less money it will have available to reinvest in the business or pay dividends to shareholders.

Feeling the Pinch: How Debt Can Cause Headaches for Your Business

Secondly, debt can be a major source of stress for business owners, managers, employees and clients. When a business has a lot of debt, it can feel like a constant weight on the shoulders of those responsible for managing the company. Debt can limit a business’s options and force it to make difficult decisions about how to allocate resources and straining employees to overload on already harsh conditions. It can also make it harder for a business to weather economic downturns or unexpected events, as debt payments must still be made even when revenue is down.

Another problem with debt is that it can limit a business’s ability to attract new investment. How can a company that was once the king of toy retail end up bankrupt due to debt and competition from e-commerce giants? When a business has a lot of debt, it can be less attractive to investors because they know that a significant portion of the company’s earnings will be going towards debt service. This can make it harder for the business to raise capital in the future, which can limit its ability to grow and expand.

Their competitor; Amazon, was able to attract investment by demonstrating early on that it could generate significant revenue and growth through its online platform. Investors recognized the potential for Amazon to disrupt traditional retail and to expand into new markets, and were willing to provide funding to support that growth. This allowed Amazon to continue to invest in innovation, expand its product offerings, and build a loyal customer base, which helped it become the giant it is today. Additionally, Amazon has been able to access debt markets at favorable rates.

Alternative Strategies for Growth and Expansion

Why risk the financial health and survival of your small business by taking on debt, when there are alternative strategies for growth and expansion? That is a valid question to ask any business owner.

Furthermore, debt can be a barrier to innovation and experimentation. When a business has a lot of debt, it may be reluctant to take risks or invest in new projects because it needs to focus on generating cash flow to service its debt. This can make it harder for the business to innovate and keep up with changing market trends, which can ultimately lead to its decline.

For small businesses, managing debt can be a daunting task that requires careful planning and execution. But with the right support and guidance, it’s possible to manage debt effectively and achieve sustainable growth. Our business consulting services provide tailored advice and practical solutions to help small businesses navigate the risks and opportunities of debt financing. We work closely with our clients to develop customized plans for reducing costs, building business relationships, and improving cash flow. Our team of experts has years of experience helping businesses of all sizes thrive in competitive markets, and we are dedicated to providing our clients with the insights and tools they need to succeed. So why take unnecessary risks with your small business when you can partner with us to achieve your goals? Lets discuss your business goals – It’s free!

In conclusion, while debt can be a useful tool for businesses, it is not always a good thing. Excessive debt can be a burden on a business’s finances, limit its options, and create stress for its owners and managers. It can also make it harder for the business to attract new investment, limit its ability to innovate, and create a negative cycle that can be hard to break. As such, businesses should be careful when taking on debt and always consider the long-term implications of their borrowing decisions.

Disclaimer: Please note that the information provided is for general informational purposes only and is not intended to be legal or professional advice. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability with respect to the information contained in this response. Any reliance you place on such information is therefore strictly at your own risk. We strongly advise you to consult with a licensed professional in your jurisdiction before making any decisions based on the information provided.