As financial markets brace for a potentially volatile future, Treasury bonds remain a focal point for investors seeking security. With persistent global geopolitical tensions and a host of uncertainties—including trade disputes and evolving international relations—the demand for U.S. Treasuries is expected to grow. Market analysts are closely monitoring these developments, as they could significantly influence investor sentiment and the direction of yields.

Zhijian Zhang an Intern Investment Analysts highlighted the implications of current geopolitical dynamics on Treasury bonds, stating, “Global geopolitical tensions and uncertainties—such as conflicts, trade issues, and changes in international relations—impact investor sentiment and demand for safe-haven assets like U.S. Treasuries. For instance, increased geopolitical risk may lead investors to flock to Treasury bonds, temporarily pushing yields lower despite broader inflationary pressures.”

This sentiment is supported by recent trends, which show that in times of crisis, investors often shift their portfolios towards safer assets, deeming Treasury bonds a reliable choice. Factors such as ongoing conflicts, economic sanctions, and shifts in diplomatic relations can lead to a surge in demand for these government-backed securities.

However, the evolving landscape does not come without challenges. Inflationary pressures, driven by supply chain disruptions and rising energy prices, pose a complex backdrop that could eventually counteract the safe-haven appeal of Treasuries. As the Federal Reserve grapples with interest rates in response to shifting economic indicators, the delicate balance between inflation and safety will continue to shape treasury yields.

While the future of Treasury bonds remains intricately linked to geopolitical realities, the current climate appears to reinforce their status as a bastion of financial stability for concerned investors. As global events unfold, the market will keenly watch how these factors play out in the quest for secure investment returns.

US Treasuries: A Comparison with Global Counterparts

These debt securities issued by the U.S. Department of the Treasury have a significant influence on global financial markets, often compared with similar instruments from other countries. Understanding US Treasuries in relation to international counterparts is essential for investors seeking to diversify their portfolios.

One primary distinction is the perceived risk and return associated with US Treasuries compared to those from other nations. For example, countries with stronger economies and stable governments, such as Germany or Japan, offer their own sovereign bonds that are also considered low-risk. However, the yields on these bonds may be lower than those on US Treasuries, making the latter more attractive for risk-averse investors looking for higher returns.

In times of economic uncertainty, US Treasuries are often viewed as a safe haven. Alongside other countries’ securities, they become a pivotal choice for investors seeking capital preservation. While political stability and economic growth rates influence yield differentials, US Treasuries continue to shine due to the U.S.’s substantial monetary influence on the global stage.

However, factors such as inflation, interest rates, and geopolitical tensions can also affect the desirability of US Treasuries compared to other countries. It is crucial for investors to conduct thorough research and keep an eye on global financial developments before making investment decisions regarding US Treasuries in comparison to international securities.

Disclaimer: The information provided is for informational purposes only and should not be considered investment advice. Always consult a financial advisor before making any investment decisions.

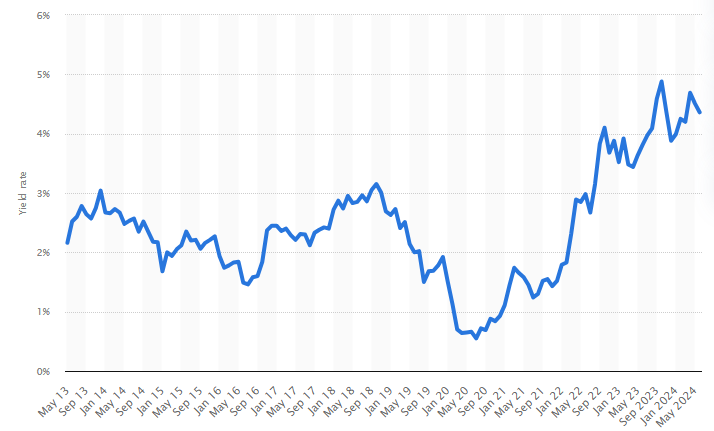

Source: Statista, Monthly development of ten year treasury bond rates in the United States from May 2013 to June 2024

Opinion: The Benefits of US Treasuries for Businesses

Businesses seeking stable investment options often find that US Treasuries present an appealing avenue for capital allocation. These government-backed securities are renowned for their liquidity and low risk, making them an excellent choice for companies aiming to preserve capital while earning returns.

One of the most significant benefits of US Treasuries for businesses lies in their liquidity. Treasuries are among the most actively traded securities globally, allowing companies to easily buy and sell their holdings as needed without significant loss in market value. This characteristic also helps businesses manage cash reserves more effectively.

Another compelling advantage is the predictable returns associated with US Treasuries. By investing in Treasuries, businesses can anticipate bond payments, making it easier to align cash flow management with operational budgets. The fixed interest payments provide a reliable income stream over the life of the bond, assisting in financial planning.

As the business world continues to change at a breakneck pace, small companies are turning to IT and AI consulting to unlock new levels of efficiency and innovation. At Wyoming Investor we provide one-to-one business consulting. These consulting services provide essential insights and strategies that enable small businesses to harness technology, streamline operations, and make data-driven decisions.