The Anchor of Financial Security

Understanding Utility Stocks: A Guide to Stability

In the ever-changing world of investments, the allure of utility stocks remains unwavering. Delving into the steadfast realm of National Grid UK, investors and business owners alike can find reassurance in the reliability and resilience intrinsic to utility stocks. To comprehend the foundation of this stability, refer to authoritative educational materials like “Investing in Utility Stocks” by renowned financial analysts.

Educational Reference: Investopedia – Investing in Utility Stocks

Energy Sector Resilience: A Case for Conservative Investors

Exxon and the Energy Sector: A Conservative Perspective

Examining the robustness of energy stocks, exemplified by industry giant Exxon, reveals an essential component for conservative portfolios. As the global demand for energy continues its upward trajectory, conservative investors and business owners can rely on companies like Exxon for steady returns and growth potential. Gain valuable insights into the conservative appeal of energy stocks with a detailed study like “Conservative Strategies in Energy Stock Investment.”

Educational Reference: Financial Times – Conservative Strategies in Energy Stock Investment

Southern Co.: Shining a Light on Prudent Investing

Southern Co.: A Beacon of Stability in Utility Investments

Southern Co. stands as a testament to the fusion of innovation and stability within the utility sector, offering a prudent investment option for conservative portfolios. Explore the nuances of Southern Co.’s success to uncover insights that align with conservative investment principles.

Educational Reference: NYSE – Southern Company Overview

Predictive Precision: Wyoming Investor’s Conservative Success Story

Wyoming Investor Conservative Predictions: National Grid and Exxon

In a recent triumph, Wyoming Investor accurately predicted the future trajectories of National Grid UK and Exxon, showcasing a conservative approach that sets it apart in the world of business consulting.

Wyoming’s Strategic Oracle: Wyoming Investor Prophecies Shaping Utility and Energy Investment

We were the first company to provide our subscribers of our opinion on the rise and conservative stability of National Grid on December 22, 2023 and January 20, 2024. For an in-depth exploration of these opinion posts you can explore these links:

Investing for Conservative Values

Empowering Conservative Investors and Industries

Utility and Energy Stocks: A Cornerstone for Conservative Portfolios

1. Stability Amidst Uncertainty

For conservative investors and business owners, the stability provided by utility stocks becomes a crucial component in navigating economic uncertainties. National Grid UK’s regulated revenue model, for instance, acts as a conservative shield against market volatilities, offering a reliable income stream even in turbulent times.

2. Fueling Conservative Industrial Growth

Industries reliant on energy find solace in conservative investments in energy stocks like Exxon. These investments not only provide conservative returns but also contribute to the growth and sustainability of sectors that form the conservative backbone of our economy.

Our Conservative Consulting Excellence

Unlocking Potential: Why Wyoming Investor is the Premier Choice for Conservative Investors and Business Owners

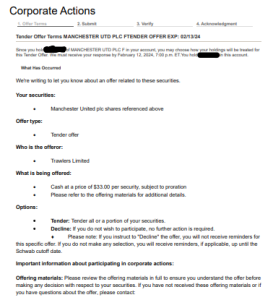

1. Strategic Advisory on Conservative Tender Offers

Wyoming Investor, was the first company in the U.S to bring awareness to clients and advice on tender offers that are grounded in conservative principles, ensuring businesses make prudent decisions in the intricate landscape of mergers and acquisitions. The tender offer was a 69.23% surge.

2. Meticulous Business Valuation Services for Conservative Decision-Making

Our conservative business valuation services provide a comprehensive understanding of the true worth of enterprises, aiding conservative decision-makers in making informed and cautious investment choices.

3. Opinion Letters: Navigating Regulatory Terrain with a Conservative Approach

Wyoming Investors’ opinion letters are renowned for their precision and foresight, helping businesses navigate regulatory challenges conservatively, with confidence and compliance.

Conclusion: Navigating Conservatism for Financial Success

In conclusion, the conservative approach to utility and energy stocks unveils a path to stability that aligns seamlessly with the principles of conservative investors and business owners. National Grid, Exxon, and Southern Co. stand as beacons of success, illustrating the potential these conservative sectors hold. Wyoming Investors’ predictive precision and unparalleled conservative business advisory services make it the go-to choice for those seeking to unlock the full potential of their conservative investments and navigate the complexities of the business landscape with a cautious mindset.

Disclaimer: Not Financial Advice

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The content is not intended to be a substitute for professional financial guidance or personalized investment advice.

Investing and financial decisions involve risk, and readers are encouraged to conduct their own research and consult with qualified financial professionals before making any investment decisions. The author and publisher of this article are not financial advisors and do not assume any responsibility for the accuracy, completeness, or suitability of the information provided.

All investment decisions and actions taken based on the information in this article are at the sole discretion of the reader. The author and publisher disclaim any liability for any direct, indirect, or consequential loss or damage arising from or in connection with the use of or reliance on any information presented in this article.

Readers are reminded that past performance is not indicative of future results, and the value of investments may fluctuate. The content of this article may be subject to change without notice, and the author and publisher do not guarantee its accuracy or completeness.

It is essential to seek professional advice tailored to individual circumstances before making any financial decisions. The reader is solely responsible for evaluating the risks and merits associated with the use of any information provided in this article and should exercise caution and diligence in doing so.