How can small businesses thrive in the complex landscape of U.S. tariffs? Understanding the historical context and current dynamics of tariff policies is essential for any entrepreneur looking to succeed in today’s economy.

This article breaks down the key considerations surrounding tariffs, their implications for small businesses, and the need for strategic planning in a potentially inflationary environment.

The Historical Context: Nixon and Tariffs in the 1970s

The roots of modern U.S. tariff policy can be traced back to the 1970s when President Richard Nixon implemented a series of tariffs aimed at protecting American industries. In a time of economic uncertainty, these measures were intended to support domestic manufacturers against foreign competition. Nixon’s tariffs were not merely a short-term fix; they signaled a broader trend in U.S. trade policy that continues to influence business decisions today.

For small businesses, this historical precedent underscores the importance of staying informed about tariff developments. As trade policies shift, businesses that rely on imported goods or export markets must adapt to new realities. The lessons from the Nixon era remind entrepreneurs that tariffs can impact pricing, supply chains, and ultimately, profitability. Today, as we witness a resurgence of protectionist sentiments, small businesses must keep a vigilant eye on tariff announcements and legislative changes that could affect their operations.

The White House Formula: A Confusing Approach to Tariffs

The current approach to tariffs under various administrations has often appeared inconsistent and puzzling, particularly the ‘reciprocal tariffs’.

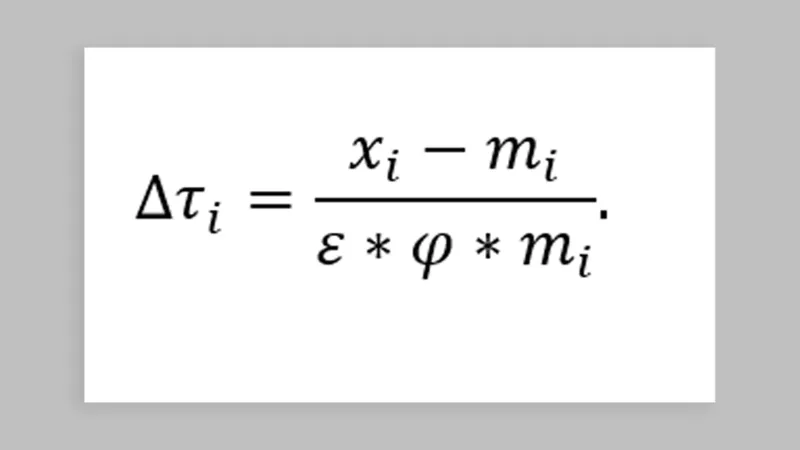

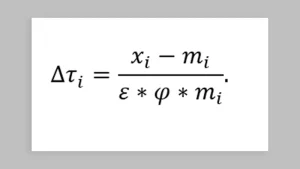

But if you unpick the formula boils down to simple maths: take the trade deficit for the U.S. in goods with a particular country, divide that by the total goods imports from that country and then divide that number by two.

Notably, tariffs have been imposed on countries that do not have a trade deficit with the U.S. For example, the U.S. has levied tariffs on goods from the UK, Australia, and Germany. Despite having positive trade relationships and trade surpluses in certain categories, these countries have faced tariffs on various products, including steel and aluminum. This highlights a fundamental flaw in the formula: it applies indiscriminately, potentially harming productive trade relationships.

For example, in specific sectors, such as services, the U.S. actually runs a trade surplus with the UK. The U.S. exports a significant amount of services (like financial services and technology) to the UK, which helps balance out the overall trade picture.

As a Small Business Owner you may be asking…how can policymakers justify imposing tariffs on countries like the UK when the economic data shows little to no trade deficit, undermining the very rationale for such measures?

Critics argue that the Republican Party’s focus on tariffs aligns with a broader agenda that prioritizes protectionism over free trade. For example, while the goal may be to protect American jobs, the unintended consequences often hurt small businesses that cannot absorb higher costs or find alternative suppliers.

While many advocate for increasing manufacturing in the U.S. to bolster domestic jobs, the reality is that these costs would likely be passed on to consumers. Unless the government steps in to subsidize these expenses or implement profit-sharing models, which seems highly unlikely, consumers will bear the burden. For instance, consider a pair of Nike sneakers that currently costs $50.00; if production shifts to the U.S. necessitating higher manufacturing costs and wages, that price could easily double to $100.00. Will the average American be willing to pay this? Yes, on one hand, they may support domestic manufacturing, but no, on the other hand, many may struggle with the increased costs, leading to difficult choices in their budgets.

Will Quality be Increased With Domestic Manufacturing?

As a business owner you must question whether increasing domestic manufacturing actually leads to improvements in quality and efficiency. Historically, cars built in Detroit during the 1970s, for instance, often did not match the fuel efficiency, maintenance reliability, or overall build quality of their German or Japanese counterparts. Brands like Toyota and Volkswagen gained a reputation for producing more durable and efficient vehicles, leaving American-made cars struggling to compete. This raises an important concern: if we shift manufacturing back to the U.S. without addressing these historical inefficiencies, will we see genuine improvements in product quality, or will we simply be paying more for goods that do not outperform their international rivals?

The inconsistency of tariff policies has led to confusion among small business owners, who may struggle to navigate a landscape that feels reactive rather than strategic. The uncertainty surrounding tariffs can deter investment and expansion, making it crucial for small businesses to seek advice from consulting firms that understand these complexities.

Preparing for Inflation: The Rising Cost of Doing Business

As tariffs rise, small businesses must brace for the potential of increased inflation. Economic studies have shown a correlation between tariff increases and rising consumer prices. For instance, a study by the National Bureau of Economic Research highlighted how tariffs imposed in recent years have led to price hikes on everyday goods, affecting the purchasing power of the average American.

Wyoming Investor has revolutionized small business consulting by providing one-to-one tailored strategies that empower U.S. businesses to navigate the complexities of today’s economic landscape, particularly in dealing with tariffs and expanding their market reach.

Our approach combines data-driven insights with practical solutions, enabling businesses to adapt to changing trade policies while optimizing their operations. By offering comprehensive support—from market analysis to licensing—we help small businesses identify opportunities for growth and resilience. Whether it’s finding alternative sourcing options or exploring new markets, our expertise ensures that American businesses are well-equipped to thrive, even in the face of challenges posed by tariffs and inflation. In doing so, we not only bolster individual enterprises but also contribute to the overall strength of the U.S. economy.

As inflation looms, small businesses need to prepare for higher operating costs, which could squeeze profit margins. Planning for price adjustments, reevaluating supply chains, and considering alternative sourcing strategies can be vital for maintaining competitiveness in an inflationary environment. The reality is that consumers will likely face increased costs, leading to changing spending behaviors that small businesses must adapt to.

Moreover, businesses that are proactive in their planning can position themselves as market leaders in a time of uncertainty. This includes not just adjusting pricing strategies but also enhancing customer engagement and exploring innovative solutions to maintain loyalty and sales.

Seeking Strategic Support: Consulting for Business Resilience

In an environment where tariff policies can change rapidly and unpredictably, the importance of having informed and strategic support cannot be overstated. Our consulting firm prides itself on being one of the few that accurately predicted Donald Trump’s election victory and the subsequent impacts on trade policy. This insight stems from a deep understanding of economic trends and political dynamics that affect small businesses across the nation.

We encourage small business owners to seek consulting services that offer tailored strategies for navigating the complexities of tariffs and their broader economic implications. With the right guidance, businesses can not only survive but thrive amidst challenges. Engaging with a knowledgeable consultant can provide clarity, strategic foresight, and practical tools to mitigate risks associated with tariffs and inflation.

Conclusion

Navigating U.S. tariffs presents both challenges and opportunities for small businesses. From understanding the historical context set by Nixon to deciphering the often confusing current policies, it is crucial for entrepreneurs to remain informed. As inflation looms, proactive preparation becomes essential, ensuring that businesses can adapt to rising costs and shifting consumer behavior.

By seeking expert small business consulting services, small business owners can gain the insights needed to navigate these turbulent waters effectively. Embracing strategic support can empower businesses to turn potential threats into avenues for growth and success in an increasingly complex economic landscape.

If you’re a small business owner looking to navigate the challenges of today’s economic environment, we invite you to reach out for a free consultation. Our team of experts is dedicated to helping you identify strategies that can enhance your operations and mitigate the impacts of tariffs and rising costs. Whether you need assistance with supply chain optimization, market expansion, or financial planning, we are here to provide the insights and support you need to thrive. Don’t miss this opportunity to empower your business for success—contact us today to schedule your free consultation and take the first step toward a stronger, more resilient future.